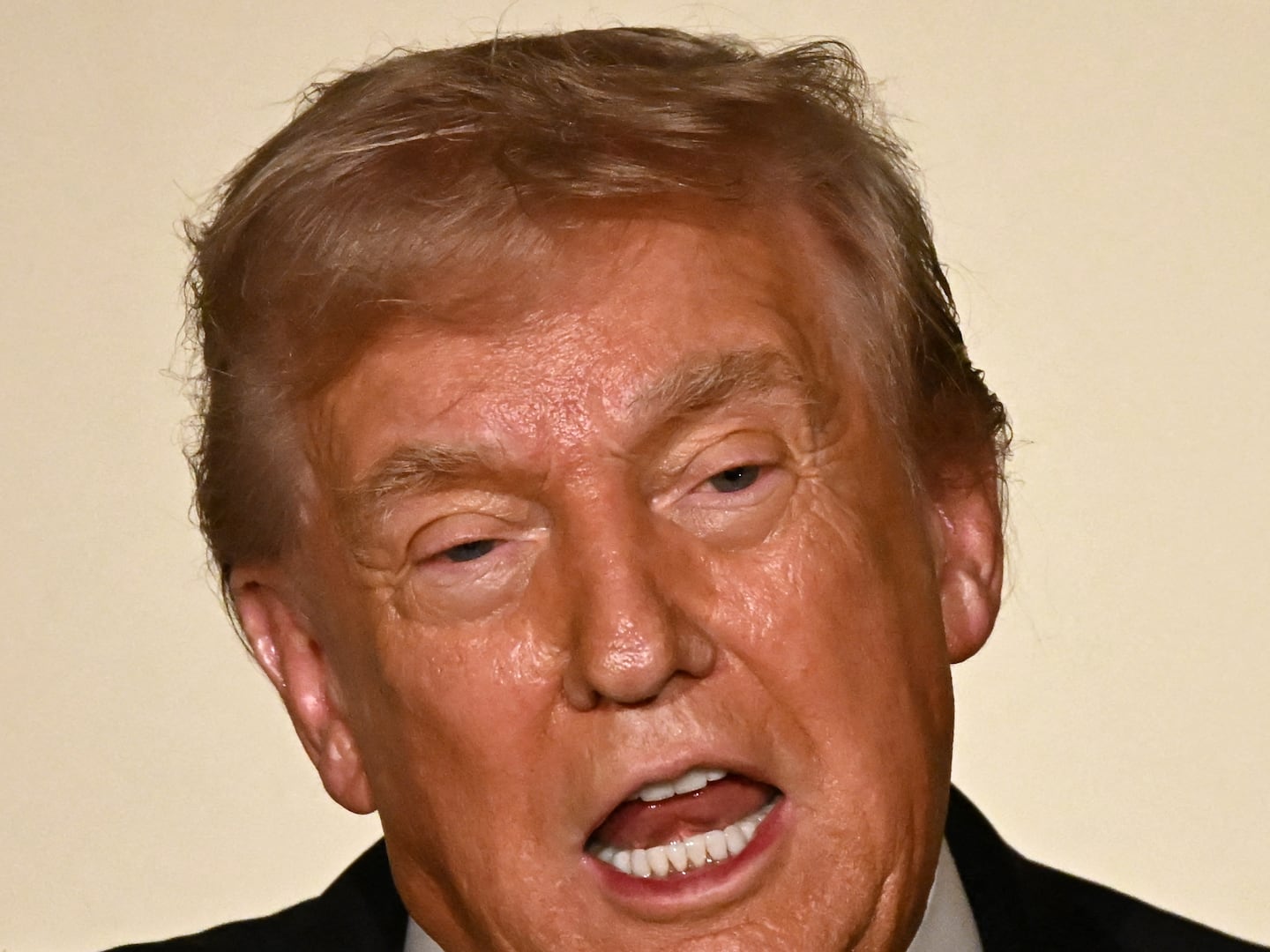

A CNBC panel sounded the alarm Wednesday after President Donald Trump declared “Liberation Day” and slapped sweeping “reciprocal” tariffs on dozens of countries, sending global markets into turmoil.

“This is probably worse than the worst case scenario that was modeled,” CNBC analyst Bonawyn Eison said on Fast Money, referring to the sheer size of Trump’s tariffs—and their effect on the stock market.

Fellow panelist Steve Liesman, CNBC’s senior economics reporter, suggested Trump was operating in his own economic reality: “This just seems like the president having his own sort of school of economics that’s different from everybody else.”

Liesman cited a scathing statement from the libertarian Cato Institute which said: “For all of President Trump’s talk of a new golden age, this huge tax increase will inevitably result in higher prices for American families, lower growth and business investment, and diminished exports and manufacturing output.”

“So it is not a good forecast,” Liesman added. “Economists believe it will lead to lower growth and higher inflation and it really puts the Fed in a pickle here.”

In a ceremony Wednesday, Trump declared a national emergency to give himself broad power to put a 10 percent tariff on all imported goods, and said 25% tariffs on all foreign-made autos would go into effect at midnight.

The president also slapped tailored “reciprocal tariffs” on imports from 60 countries, claiming that the U.S. has been “looted, pillaged, raped, plundered” by other nations for decades.

Stocks plunged in after-hours trading as investors recoiled at Trump’s move, which threatened to upend the global economic order and spark broader trade wars.

As of publication, Dow futures were down 0.61%, S&P 500 futures fell 1.69%, and futures tied to the Nasdaq 100 slid 2.54%.

Most economists expect that the tariffs, which are taxes levied on U.S. importers, will lead to sluggish growth and higher prices.

Democrats for their part, have sought to brand the tariffs as a tax increase on American families.