The opening salvo in President Donald Trump’s trade war rocked global markets Monday, with investors dumping key stocks and risky assets as fears take hold of sharp price increases.

Japan’s Nikkei share average fell 2.6 percent and Australia’s benchmark ASX200 1.8 percent.

In the European Union—which Trump has singled out as his next tariff target—a Monday morning selloff hammered carmakers, with technology, industrials, and mining firms also taking losses.

ADVERTISEMENT

German automaker Volkswagen, which shipped more than half a million vehicles to the United States from Mexico last year, fell 4 percent. Rival European auto giant Stellantis—which manufactures Chrysler and Jeep vehicles—slumped 4.3 percent.

Germany’s blue chip DAX fell 1.5 percent and France’s CAC-40 fell 1.2 percent, the two indices representing the bloc’s two largest economies.

The drops followed Trump’s decision on Saturday to order 25 percent tariffs on goods from Mexico and most imports from Canada, as well as a 10 percent levy on goods imported from China—to be paid by U.S. importers and consumers.

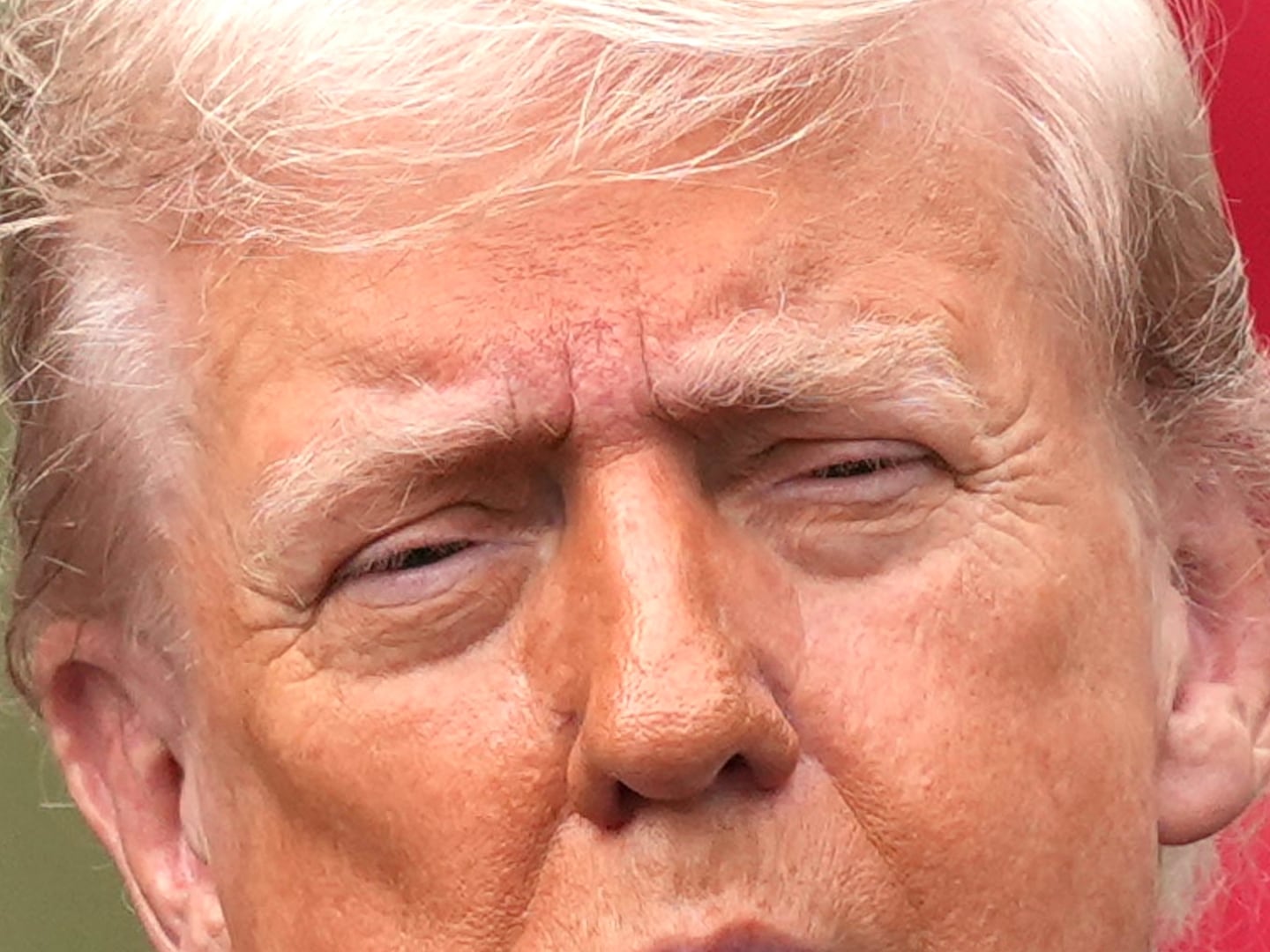

“It will definitely happen with the European Union, I can tell you that,” Trump told reporters Sunday, of his plans to expand his global trade war across the Atlantic. “I wouldn’t say there’s a timeline but it’s going to be pretty soon.”

Canada announced immediate retaliatory tariffs, while Mexico said Monday that Trump agreed to delay tariffs for one month.

China vowed to challenge the tariffs at the World Trade Organization and roll out its own countermeasures.

“This action is utter madness,” said Chrystia Freeland, the former Canadian finance minister who is running to replace Justin Trudeau as prime minister, during an appearance on CNN. “It is a betrayal of America’s closest friend—your ally, your neighbor, your best partner in the whole world. It is an act of economic warfare.”

Trump’s tariffs are expected to drive up prices for consumers and companies in the United States and abroad, touching on everything from food to appliances to smartphones.

In North America, in particular, they will throw a multibillion-dollar wrench into supply chains that have benefitted from decades of multilateral economic partnership and cooperation.

“The resulting surge in U.S. inflation from these tariffs and other future measures is going to come even faster and be larger than we initially expected,” said Paul Ashworth, the chief North American economist at Capital Economics. “Under those circumstances, the window for the Fed to resume cutting interest rates at any point over the next 12 to 18 months just slammed shut.”

The president acknowledged over the weekend, in a social media post, that his trade warring may cause “pain,” but insisted “it will all be worth the price that must be paid.”

In the U.S., stock markets suffered an initial selloff, but pared losses after Mexico announced Trump had agreed to delay tariffs on its Southern neighbor by a month.

The Dow Jones Industrial Average was down 0.3 percent as of noon, the tech-heavy NASDAQ Composite down roughly 1.3 percent, and the S&P down 0.8 percent.

Economists at Goldman Sachs, however, forecasted that tariffs could have a lasting impact on U.S. equities.

“These announcements have come as a shock to many investors who expected tariffs would only be imposed if trade negotiations failed,” the Wall Street bank wrote in an investor note Sunday.

Earnings per share for companies listed on the S&P 500 could decline as much as two to three percent because of the tariffs, Goldman economists said.

The broader index could fall as much as five percent in the next few months, they added.

The market frenzy unleashed by Trump also drove investors away from cryptocurrencies.

While Trump has pledged to be a crypto-friendly president and touted his own meme coin, cryptocurrencies are viewed by many investors as especially risky assets in times of economic uncertainty.

Bitcoin, the world’s biggest cryptocurrency, touched a three-week low of around $91,441.89 overnight and was down roughly 4 percent to $95,354.64 Monday morning in Europe.