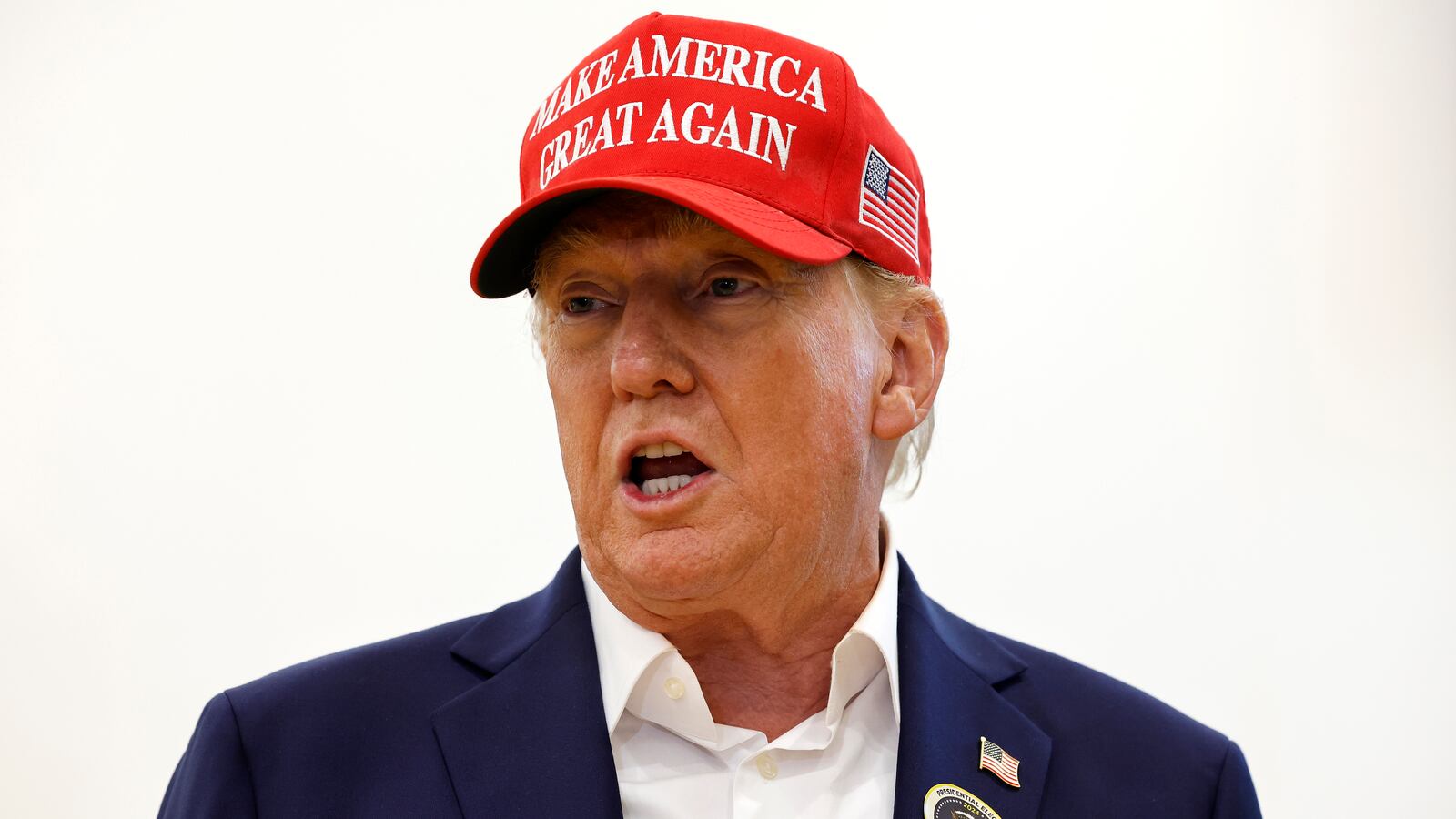

The S&P 500 is on course for its worst run during a president’s first 100 days in office in over 50 years under the second Trump administration. The key benchmark for U.S. stocks rocketed to its highest-ever post-election gain when Trump was re-elected in November. But in a startling reversal of fortune, the index is now down by about 8 percent since his inauguration amid Trump’s chaotic trade war and tariff policies. That’s the biggest drop in a president’s first 100 days since Gerald Ford oversaw an 11.8 percent decline in 1974 following Richard Nixon’s resignation, according to Bloomberg. “What he was elected for was ‘Make America Great Again,’ the ‘economy will be booming,’” Eric Diton, president and managing director at Wealth Alliance, told the outlet. “But all the trade uncertainty has actually detracted from economic growth.” Even if Trump does manage to “make some deals,” the economic downward spiral may be difficult to escape, another trader explained. “There is irreparable damage done,” Mark Malek, chief investment officer at Siebert, told Bloomberg. “Trend and momentum are extremely important in the stock market and they really reflect investor sentiment. Unfortunately these things are very hard to turn back around when they go down so fast.”